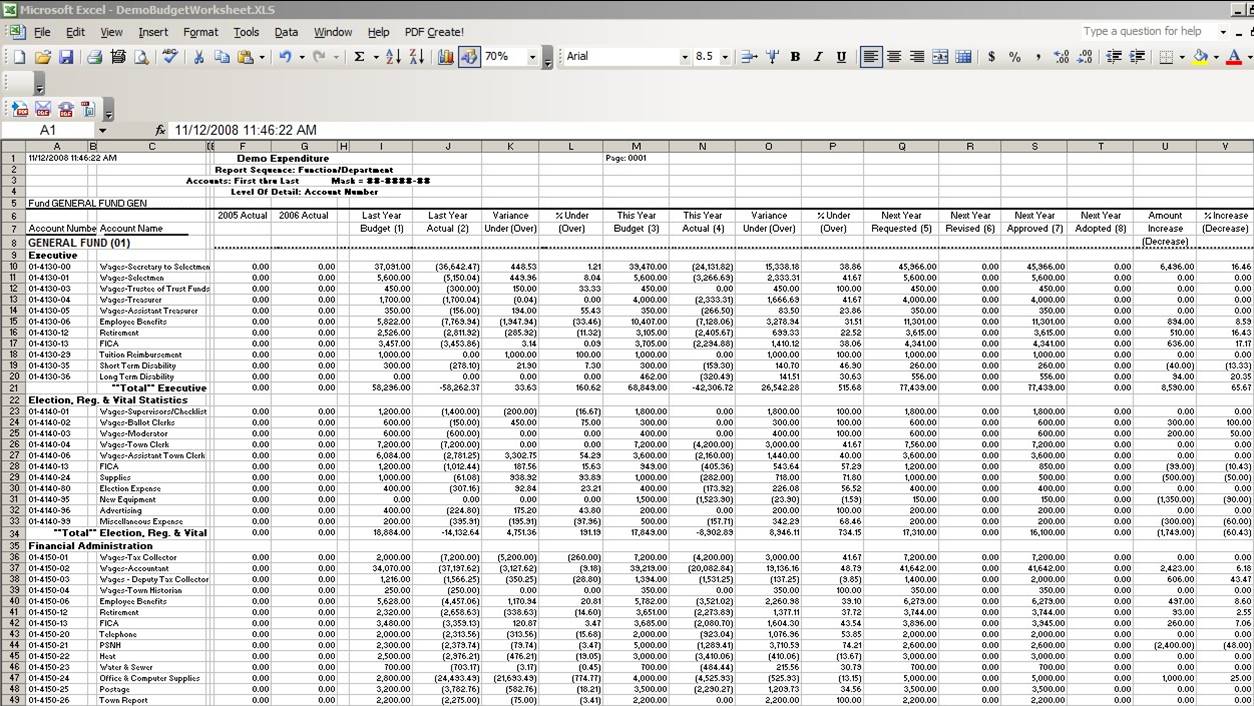

Quantity: If you’re buying, use a positive number.You can use any identifier you want to help you remember what you traded. Entry date: The date you opened the position.Here are some details about the column and row headers on the spreadsheet. It’s best to keep your journal current otherwise you might build up a backlog of trades and it’ll be a struggle to remember why you entered or exited each one. That’s fun, but always remember that the biggest benefits of a journal will be found in three columns: the profit or loss on each trade, why you did it, and what you learned from that trade.Įvery trade gets an entry in your journal, and it gets entered as quickly as possible after each trade. If you’re an Excel wonk, you can go bananas calculating the most obscure ratios and making distant forecasts about how much your portfolio might be worth in ten years. I’ve color-keyed each cell to show what you need to enter and what is calculated for you. If you scale into or out of a position, each lot gets its own line. You’ll start to spot what’s working and, even more importantly, avoid making the same mistake time after time.

A trading journal performs the same function. Anyone who has ever kept a personal diary knows the value of being able to reflect on the past and learning from it. Why are trading journals important?Ī trading journal will help you develop a trading style that fits your personality and beliefs about the market. It's not the most elegant spreadsheet, perhaps, but it does what I need. I've made it available here please feel free to download a copy if you're interested. I've had quite a few requests for a copy of the spreadsheet I use for my trading journal.

Excel free spreadsheet templates how to#

Read my guide to the Best Trading Journals for tips on how to successfully maintain your journal.

0 kommentar(er)

0 kommentar(er)